Market overview

Russian economy in 2018

In 2018, Russia saw a number of macroeconomic improvements, with the GDP growth rising to 2.3% from 1.6% in 2017 (the data is hereinafter stated according to the information provided by the Russian Federal State Statistics Service).

The expansion was driven by an increase in Russian export prices against stronger market performance in 1H 2018 and growth in domestic demand. In 2018, key GDP drivers included:

- the mining industry;

- transportation and storage services;

- construction;

- financial and insurance services.

Industrial production growth, which is crucial for the rail freight sector, increased to 2.9% in 2018 (compared to 2.1% in 2017), in no small part thanks to:

- 4.1% growth in the mining industry (vs 2.1% in 2017);

- 2.6% growth in the manufacturing sector (vs 2.5% in 2017).

There was also a rise in the domestic consumer demand in 2018, with retail trade growing by 2.8% (vs 1.3% in 2017). Overall, the consumer market was boosted by high retail lending and an increase in real salaries. Capital investments kept growing relatively fast and were up 4.3% by the end of 2018 (vs 4.8% in 2017).

External demand had a significant impact on the Russian economy in 2018. Exports continued to be the key economic driver in Russia, with the y-o-y growth rates remaining practically unchanged y-o-y (25.3% in 2018 vs 25.5% in 2017).

Freight transportation market

Freight turnover

According to the Russian Federal State Statistics Service, in 2018, freight turnover in Russia increased by 2.8% y-o-y to 5,640 bn tkm. Growth was reported across the transport modes, except for the sea (-10.3%) and air (-0.7%) transport and inland waterways (-6.8%).

Loaded freight turnover in the railway segment added 4.2%. Railway transport accounted for 46.1% of total freight turnover (up 0.7 pp vs 2017) or 87.4% (up 0.6 pp vs 2017) with the pipeline transport excluded.

Freight transportation market outlook according to the Long-Term Development Programme

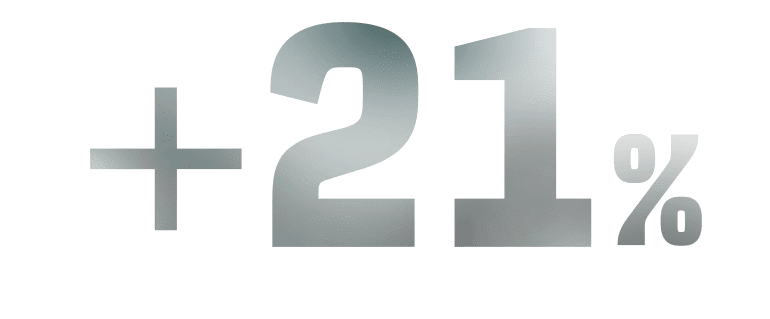

Under the Programme’s base case scenario, freight turnover in 2019–2025 is set to increase by 21%

Under the base case scenario, handling volumes are expected to grow at a moderate average annual rate of 2.4% and add 18% by 2025 driven by an increase in coal shipments

| Transport mode | 2018 | Y-o-y change, % | Share in total freight turnover, % | |

|---|---|---|---|---|

| 2017 | 2018 | |||

| All transport modes | 5,640.0 | 2.8 | 100 | 100 |

| RailwayExcluding empty runs of own railcars. | 2,597.8 | 4.2 | 45.4 | 46.1 |

| Including the infrastructure of Russian Railways and Yakutia Railways | 2,596.9 | 4.2 | 45.4 | 46.1 |

| Road | 259.1 | 2.3 | 4.6 | 4.6 |

| SeaFor reference: freight transportation by sea and internal waterways includes shipments made under freight transportation contracts by the company’s own and/or leased (chartered) vessels (including vessels leased to foreign companies (charterers) under time charter arrangements) flying the flag of the Russian Federation with the relevant shipping documents in place. | 44.9 | –10.3 | 0.9 | 0.8 |

| Inland waterwaysFor reference: freight transportation by sea and internal waterways includes shipments made under freight transportation contracts by the company’s own and/or leased (chartered) vessels (including vessels leased to foreign companies (charterers) under time charter arrangements) flying the flag of the Russian Federation with the relevant shipping documents in place. | 62.6 | –6.8 | 1.2 | 1.1 |

| Air (transport aviation) | 7.8 | –0.7 | 0.1 | 0.1 |

| Pipeline | 2,667.8 | 2.0 | 47.7 | 47.3 |

| For reference: | ||||

| Share of railway transport excluding pipelines | 86.8 | 87.4 | ||

| Share of Russian Railways excluding pipelines | 86.8 | 87.4 | ||

Passenger transportation market

Passenger turnover

In 2018, Russia’s passenger turnover increased by 6.6% y-o-y to 531.9 bn pkm, including:

- 129.5 bn pkm in railway transport;

- 114.8 bn pkm in road transport;

- 286.9 bn pkm in air transport.

Passenger turnover growth in the public transport segment was mainly driven by a 10.6% increase in air transportation. Air transport accounted for 53.9% of total public transport passenger turnover (up 1.9 pp vs 2017). Despite a 5.2% y-o-y growth, the share of railway transport in total passenger turnover went down by 0.3 pp to 24.4%. Passenger turnover in the road transport (bus service) segment decreased by 1%, with this segment’s share in total public transport passenger turnover amounting to 21.6% (down 1.6 pp vs 2017).

Passenger transportation market outlook according to the Long-Term Development Programme

Under the Programme’s base case scenario, by 2025 passenger turnover in Russia is set to increase by 20% if compared to the 2018 levelBased on economic outlook for 2018 used in drafting the Long-Term Development Programme.. The growth is expected to be driven by expansion of the procurement programme for new passenger railcars to an average of 600 railcars per year, introduction of new marketing initiatives, further development of the Central Transport Hub, and income growth stimulating increased mobility.

According to the base case scenario, passenger traffic is set to grow by 15%.

| Transport mode | 2018 | Y-o-y change, % | Share in total passenger turnover, % | |

|---|---|---|---|---|

| 2017 | 2018 | |||

| Public transportExcluding intra-urban transport., total | 531.9 | 6.6 | 100.0 | 100.0 |

| Railway | 129.5 | 5.2 | 24.7 | 24.4 |

| Including Russian Railways’ infrastructureRussian Railways’ data. | 129.4 | 5.2 | 24.6 | 24.3 |

| Road (bus service) | 114.8 | –1.0 | 23.2 | 21.6 |

| Inland waterways | 0.6 | –1.5 | 0.1 | 0.1 |

| Air | 286.9 | 10.6 | 52.0 | 53.9 |