Analysis of financial results (IFRS) The consolidated IFRS financial statements of Russian Railways and its subsidiaries for 2018 and the auditor report are available on Russian Railways’ website.

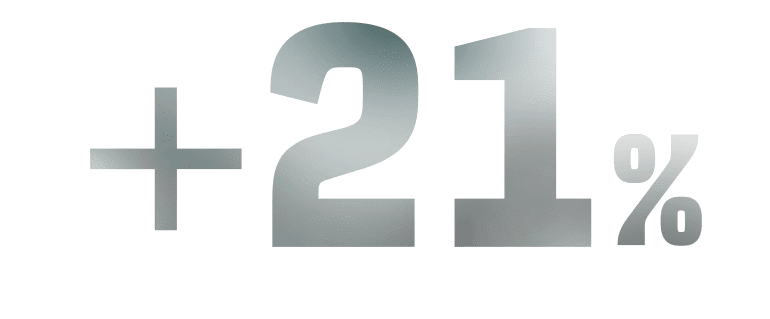

Our continuous efforts to improve interaction with shippers and better utilisation of the rolling stock boosted the growth of freight transportation. The Company’s operational excellence also translated into strong financials. As a result, the Group’s income in 2018 grew by 7.2% y-o-y to RUB 2,413 bn vs RUB 2,252 bn in 2017. Our EBITDA rose by 6.4% to RUB 527 bn, while EBITDA margin amounted to 24.7%Hereinafter, the EBITDA margin takes into account the adjustments for third-party service costs related to integrated freight forwarding and logistics services.on the back of strong operating results and cost controlsVadim Mikhailov First Deputy CEO of Russian Railways

Our continuous efforts to improve interaction with shippers and better utilisation of the rolling stock boosted the growth of freight transportation. The Company’s operational excellence also translated into strong financials. As a result, the Group’s income in 2018 grew by 7.2% y-o-y to RUB 2,413 bn vs RUB 2,252 bn in 2017. Our EBITDA rose by 6.4% to RUB 527 bn, while EBITDA margin amounted to 24.7%Hereinafter, the EBITDA margin takes into account the adjustments for third-party service costs related to integrated freight forwarding and logistics services.on the back of strong operating results and cost controlsVadim Mikhailov First Deputy CEO of Russian Railways

Russian Railways’ consolidated IFRS financial statements include the results of 206 subsidiaries.

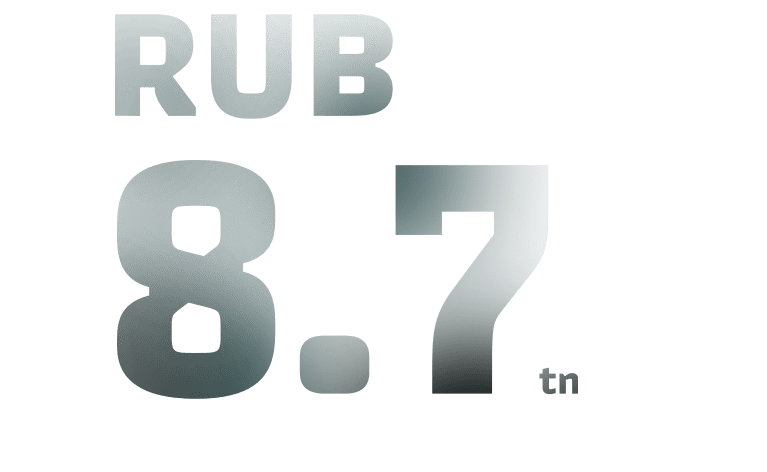

In 2018, the Group’s income grew by 7.2% y-o-y to RUB 2,413 bn vs RUB 2,252 bn in 2017. This growth was mainly attributable to income from freight transportation and infrastructure services going up by 5.6% y-o-y to RUB 1,531 bn.

In 2018, the Group’s operating expenses (net of impairment expenses) increased to RUB 2,161 bn due to a higher freight turnover, rising repair expenses and a surge in diesel fuel prices.

In 2018, EBITDA went up by 6.4% y-o-y to RUB 527 bn vs RUB 496 bn in 2017. EBITDA margin for 2018 amounted to 24.7%.

The Group’s net profit reached RUB 35.4 bn.

As at 31 December 2018, its net debt / EBITDA stood at 2.28x, an evidence of our sound financial health. The EBITDA growth coupled with the efficient debt portfolio management help us maintain a comfortable leverage well below the internal threshold of 2.5x on net debt / EBITDA.