Analysis of financial results (RAS)

In 2018, Russian Railways fared well both ensuring a balanced operating performance and shaping a long-term development focus in line with the goals set by the President and the Government of the Russian Federation. The Company’s RAS income rose by 5.9% y-o-y to RUB 1,798 bn. Our RAS EBITDA increased by 7.4% to RUB 380 bn on the back of higher income from core operationsVadim Mikhailov First Deputy CEO of Russian Railways

In 2018, Russian Railways fared well both ensuring a balanced operating performance and shaping a long-term development focus in line with the goals set by the President and the Government of the Russian Federation. The Company’s RAS income rose by 5.9% y-o-y to RUB 1,798 bn. Our RAS EBITDA increased by 7.4% to RUB 380 bn on the back of higher income from core operationsVadim Mikhailov First Deputy CEO of Russian Railways

Russian Railways’ performance ina 2018

In 2018, Russian Railways met its volume and financial targets.

The increase in freight shipments came as a sign of improvements in Russia’s economic situation.

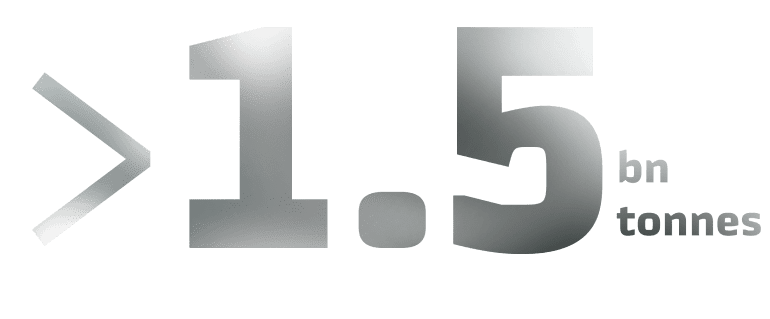

While Russia’s GDP grew by 2.3% and industrial production was up by 2.9%, the Company increased its freight shipment volumes by 2.2%. Total freight turnover added 4%.

In 2018, the Company focused on ensuring a balanced operating performance and cost management.

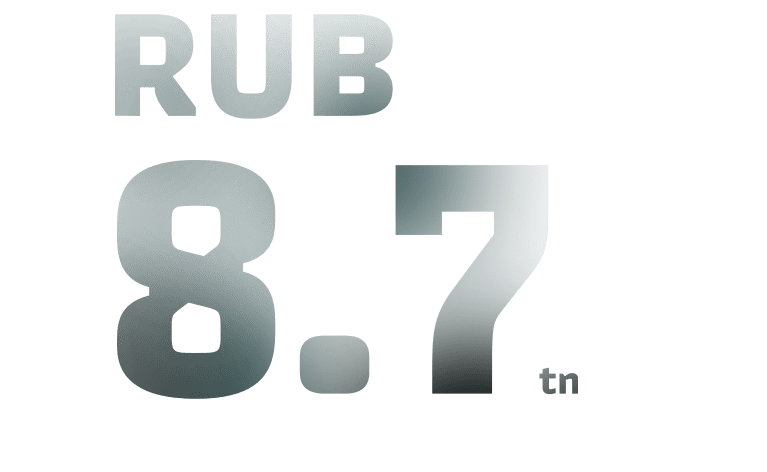

The income from core operations totalled RUB 1,798.4 bn, up 5.9% y-o-y. Income from transportation operations increased by 6.1% y-o-y.

Freight transportation yielded 6.4% more income compared to 2017. As a result of deterioration in the freight transportation mix and tariff indexation in January 2018, the revenue rate growth stood at 2.3%.

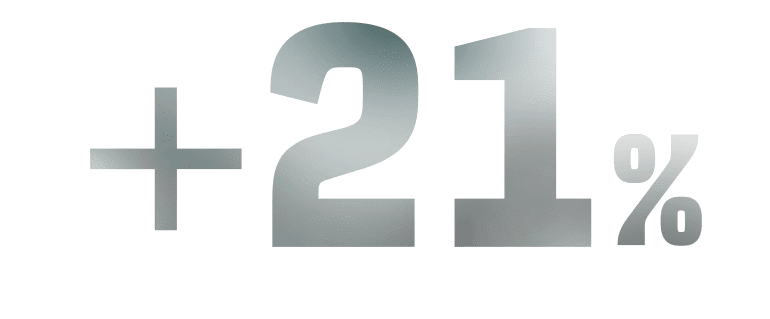

Income from passenger transportation increased by 14.3% y-o-y.

As a result of ongoing performance improvement initiatives, transportation costs increased by 2.2% y-o-y (0.9% on a comparable basis) as consumer prices grew by 2.9% and producer prices rose by 11.9%.

Income from other operations amounted to RUB 25.1 bn.

As a result, sales profit for the year increased by 0.6% and amounted to RUB 140.8 bn.

Dividends from subsidiaries and affiliates stood at RUB 19.3 bn, while sales of their shares amounted to RUB 6 bn yielding RUB 2.6 bn.The Company sold shares in Kaluga Plant Remputmash and Central SPC and a 30% stake in Trans Eurasia Logistics GmbH

The amount of interest payable remained flat y-o-y despite a higher leverage as the Company incurred additional borrowing costs. The Company continued to optimise its debt portfolio and reduce debt servicing costs, including a number of successful placements and refinancing exercises, which helped bring the weighted average annual interest rate from 7.01 to 6.1%.

As a result of the Company’s push to improve operational efficiency and financial policy, net profit increased to RUB 18.4 bn compared to RUB 17.5 bn in 2017 (target – RUB 15 bn).