Debt policy

Russian Railways uses borrowings to ensure uninterrupted financing of the Company’s investment and operating activities. The Company relies on long-term loans to fund strategically important and commercially viable investment projects and for refinancing purposes, while short-term loans provide flexibility in managing the current liquidity.

Loan portfolio performance in 2018

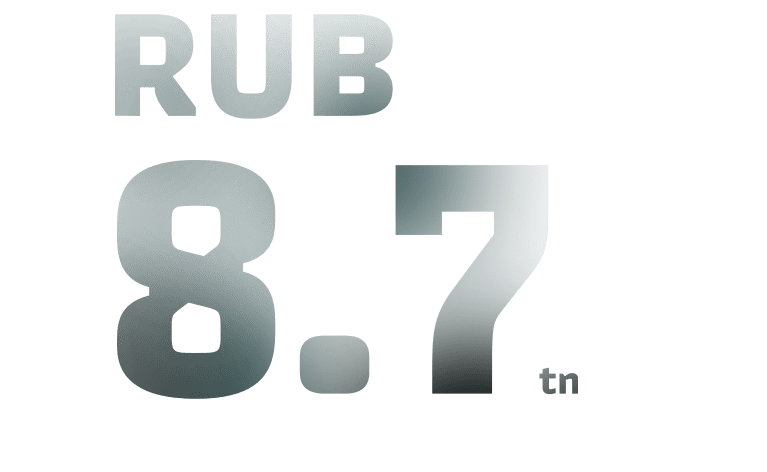

In 2018, the Company’s medium and long-term debt totalled RUB 168.7 bn. The borrowed funds were largely raised through public debt instruments held by Russian investors as well as CHF-denominated bank loans.

Russian Railways repaid a total of RUB 125.9 bn in obligations in the reporting year. The Company’s loan portfolio was significantly impacted by the rouble depreciation causing revaluation of the FX-denominated debt and an increase in its rouble equivalent at year-end. In relative terms, the share of the FX-denominated debt went down to 31% (vs 35% at the start of the year) after Russian Railways successfully redeemed part of its USD-denominated Eurobonds for ca. USD 775 m.

In addition, the Company drew down bilateral short-term (from several days to 1 year) bank and intra-group loans throughout the reporting year for the day-to-day management of liquidity and refinancing of liabilities. Since June 2018, Russian Railways has been actively implementing an intra-group cash pooling scheme to optimise its borrowing rates and efficiently use idle cash balances. As at the end of 2018, short-term liabilities stood at RUB 140 bn.

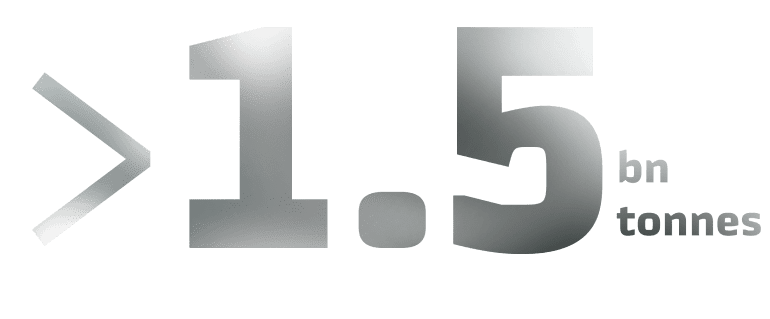

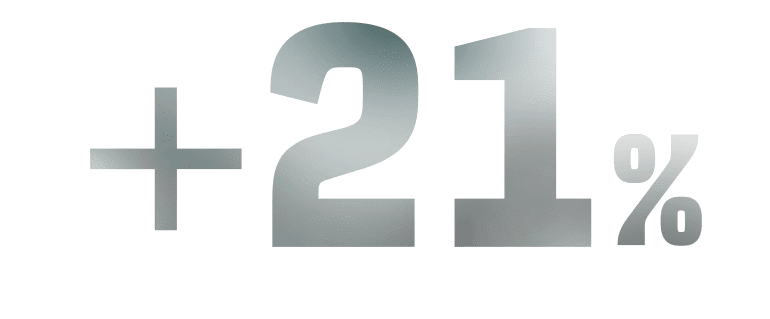

In the reporting year, the Company’s total debt grew by 17.3% to RUB 1,261.2 bn, including a 17.4% increase in the principal debt to RUB 1,245.1 bn.

Loan portfolio structure and debt policy

As at 31 December 2018, the loan portfolio of Russian Railways was as follows:

| Items | 2018 value | Threshold | Comments |

|---|---|---|---|

| Share of FX-denominated debt, % | 31.0 | Below 40.0% | FX-denominated debt in the Company’s loan portfolio adds to its exposure to FX fluctuations. However, the interest rate on FX-denominated loans is much lower than on rouble loans. It is, therefore, the debt policy's primary objective to find balance between the FX and rouble-denominated loans. |

| Short-term debt, % | 19.9 | Below 20.0 | Short-term obligations in the loan portfolio offer greater flexibility in managing the portfolio. The increased share of short-term obligations at the end of 2018 was attributable to major loans which were repaid in early 2019 using local bonds as well as rouble-denominated Eurobonds. |

| Average maturity, years | 7 | 7–10 | The Company works to increase and maintain the average maturity of the loan portfolio that would be consistent with the long payback period of the investment projects financed by such loans. |

The share of FX loans in 2018 did not exceed the threshold set by the debt policy. With a view to cutting the weighted average cost of the loan portfolio and reducing the share of FX loans, Russian Railways completed a number of successful deals in the domestic and global markets in 2018. Importantly, the Company successfully redeemed part of its USD-denominated Eurobonds for ca. USD 775 m. As a result, Russian Railways reduced the share of the FX-denominated debt to 31% bringing down the cost of its loan portfolio by 10 pp despite a deteriorating market environment in 2H 2018.

The major part of the Company’s loan portfolio (roughly a third of all borrowings) is made up of long-term borrowings, including, but not limited to, infrastructure bonds placed in favour of state-owned funds (the Pension Fund of the Russian Federation and the National Wealth Fund). The maturity of the infrastructure bonds ranges from 15 to 30 years.

The bulk of the loan portfolio is comprised of the Company’s Eurobonds placed for an average of 7 to 10 years and rouble-denominated bonds generally placed on the local market for 5 to 7 years.

As the maturity dates approach for the respective obligations, the Company replaces them with new long-term borrowings, determines their maturity taking into account the existing repayment schedule and maintaining the share of short-term liabilities for the entire scheduled horizon at a level not exceeding 20%.

As at the end of 2018, the long-term portion of the loan portfolio (maturing in more than 3 years) went down to 62% as the share of medium-term instruments increased. The short-term borrowings (maturing in less than a year) increased from the beginning of the year to 19.9% as the Company was preparing to redeem rouble-denominated Eurobonds maturing in early 2019.

As at the end of 2018, the average maturity across the Russian Railways’ loan portfolio was approximately 7 years with payments evenly distributed over the long-term horizon, thus mitigating the refinancing risks.